One of my early financial freedom dreams was to be able to afford a fishing boat. If my plans for financial freedom and early retirement don’t go to plan then I’ll be stuck with the wooden heap you can see above. But if I make the right choices and save hard I’ll be able to get something much more in line with what I’m after. Primarily something that won’t result in me risking death just a year into my financial independence! The only real way to know what the best decision is, is to look at the likely outcomes and then weigh up the risks. For instance, did you know you can probably draw your defined benefit pension early?

As I have a defined benefit pension from a previous job I was really interested to see how it stacked up financially to take the pension early. The reduction you will get will vary depending on the scheme, and so I’ll be providing a spreadsheet free to help you work out the results for your scheme. It is also worth noting that until you actually come to retire, you almost certainly won’t be able to know the exact reduction. This is because the actuaries will base it on the latest information and expectations. That said, your scheme should be able to provide you with a rough estimate of how much you would lose each year.

So, let’s see if when we model the numbers it makes financial sense or not to draw down early. Then I’ll consider some of the other reasons that might influence your decision. You can skip to the conclusion if time is tight and you don’t feel the love for my graphs.

The main assumptions we’ll use

A big caveat before you keep on reading. This analysis is based on my pension scheme and the estimates provided by them. Before you decide to actually draw down you defined pension early you should contact your provider and understand the exact impact for you.

My defined benefit pension was from a period I spent as a civil servant in the UK Government, and I’m part of the Nuvos scheme. In the documentation it explains that for each year you draw down the pension early, you will lose roughly 5% per year of your pension. The earliest you can draw down early is you your earliest retirement age which in the UK will be between 55 & 58 depending on how old you are.

The Nuvus pension will increase in line with inflation, and I assume all defined benefit schemes do the same. As such we will ignore the impact of inflation. First of all you will need to find out in today’s value what pension you will receive when you retire. This should be pretty easy to get as you will have been given statements, or you can just ask your pension provider for an update.

Even if you spend the pension that you draw in advance, you will be spending less of your other investments and will therefore benefit financially. The analysis is based on a defined benefit of £10,000 per year. The age at which different ages break-even will be the same regardless of the value of the pot.

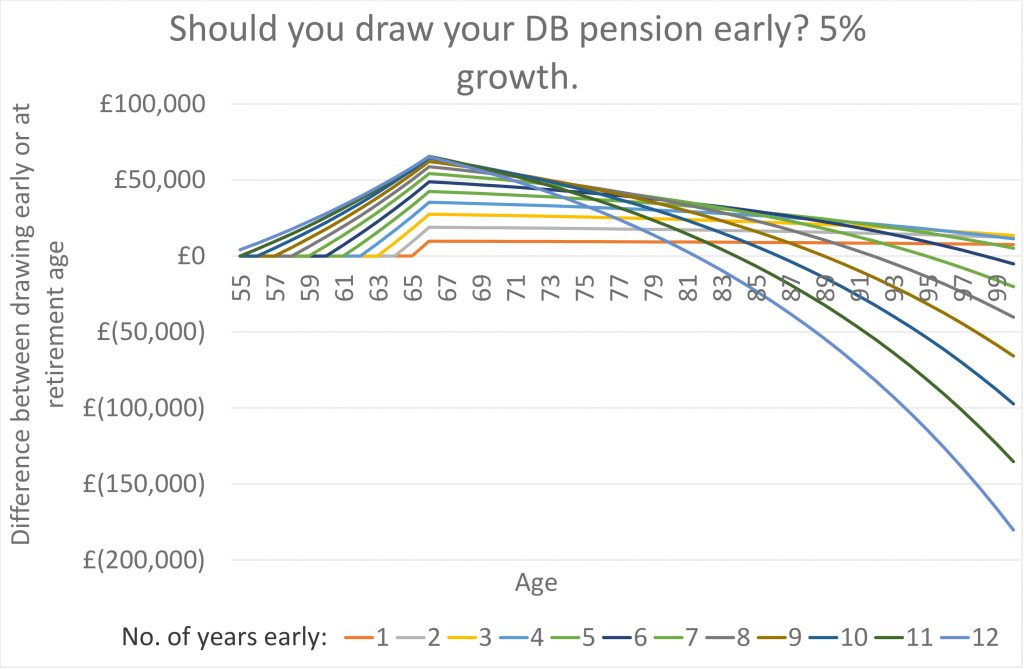

Draw your defined benefit pension early and get a 5% return on your investment

The chart to the right shows all of the options of retiring between 1-12 years early. The chart shows the difference to your net worth of drawing the pension early compared to waiting for your statutory retirement age. NB some people will not be able to retire at 55.

In this first chart I’ve assumed that your investments will be growing by 5% per year.

You might need to click on the graph to see it clearly, but the results are relatively straightforward.

- If you took the pension out ten years early, then you would need to live beyond 86 before you started to lose out financially. However, note that if you managed to live until the ripe old age of 100 you would actually be about £97,000 worse off than if you had waited until you statutory retirement age.

- Alternatively, if you took the pension out seven years early, then you would need to live beyond 95 before you started to lose out financially. And if you managed to live until the age of 100 you would only be about £20,000 worse off than if you had waited until you statutory retirement age.

Those were better results than I expected. But what about if our investments didn’t perform as well as we hoped?

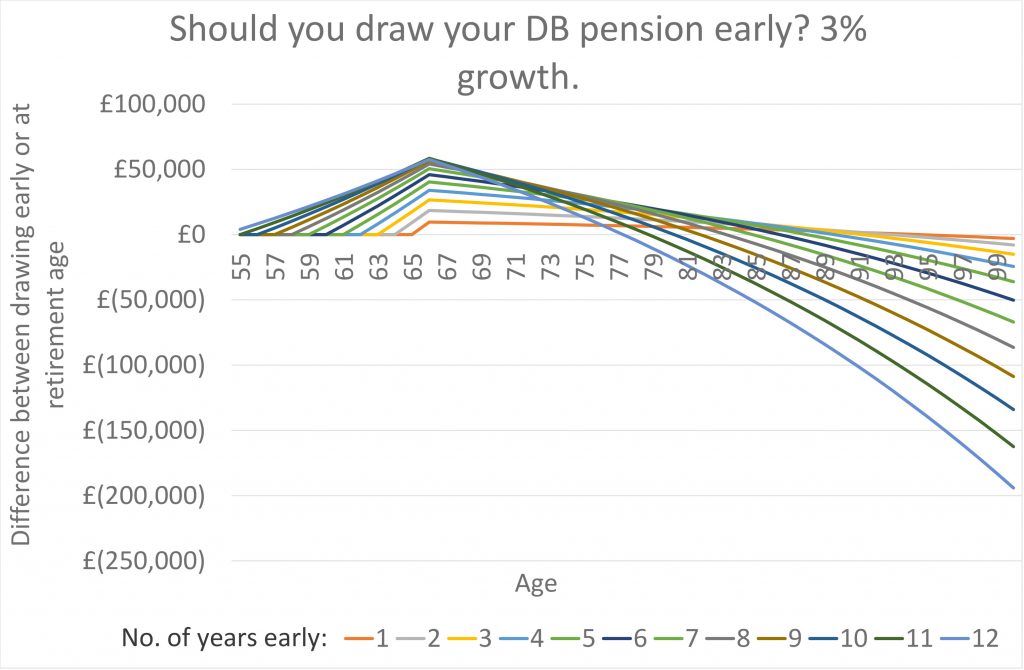

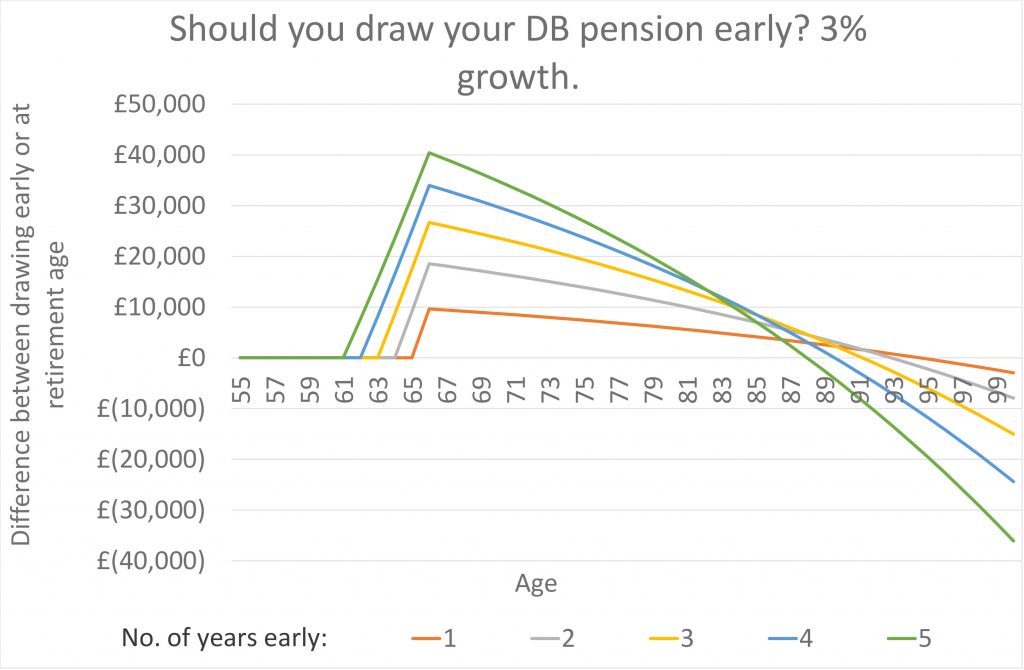

Draw your defined benefit pension early and get a 3% return on your investment

If we could only achieve a 3% return on our investments, then the results are not quite as good. I’ve provided two charts this time. The first has the outcome of retiring 1-12 years early, and the second the outcome of retiring 1-5 years early.

- If you took the pension out ten years early, then you would need to live beyond 80 before you started to lose out financially. However, note that if you managed to live until the 100 you would actually be about £134,000 worse off than if you had waited until you statutory retirement age.

- Alternatively, if you took the pension out seven years early, then you would need to live beyond 85 before you started to lose out financially. And if you managed to live until you were 100 years old you would only be about £67,000 worse off than if you had waited until you statutory retirement age.

- If you took the pension out five years early, then you would need to live beyond 88 before you started to lose out financially. However, note that if you managed to live until the ripe old age of 100 you would actually be about £36,000 worse off than if you had waited until you statutory retirement age.

Hang on… this looks like an obvious financial choice

I must admit I didn’t expect the results to look quite this good when I sat down to write this article. This was based purely on hunch rather than any consideration of the facts. On average most people would be better off by drawing down their defined benefit pension, assuming you can get the same c5% reduction per year. Considering most of us are likely to live to 80-81 even taking it out 9 years early would all things being equal not leave you any worse off.

If this seems too good to be true it it makes sense when you take a step back. Delaying by one year on £10,000 pension will cost you £500 every year thereafter. But then on the £9,500 you get in advance you can earn interest/growth on that. If you could achieve 5% growth that would equate to £238 in year 1, almost half of the reduction you took.

There are other factors to consider as we shall see shortly. But for most of us aiming for early retirement it is likely to make financial sense to draw down our defined pension

Are there other benefits to drawing down your defined benefit early?

If you’ve built up such a big pension that it exceeds what you need to actually live on in retirement then that could also influence your decision. This is not as unreasonable as it sounds if you had worked in an average salary or final salary pension scheme for all of your life.

I worked with a guy who did just that when I worked for the government. He realised at 55 he could retire and have exactly the same lifestyle as he had now. Or he could work for another 10+ years and have more money than he needed. I wasn’t at all jealous I promise you!

You might also decide that whilst you’re happy bringing in some extra income in during the early phase of your early retirement (aka the slow down phase), you want to fully stop working before your statutory age. Drawing it down a few years early could give you a nice little boost that allows you to leave your investments more intact that you otherwise expected.

The Pension Protection Fund was established to pay compensation to members of eligible defined benefit pension schemes, when there is a qualifying insolvency event in relation to the employer and where there are insufficient assets in the pension scheme to cover Pension Protection Fund levels of compensation.

Perhaps less likely, but if you happen to work (or have worked) for a struggling company that you think might be about to go bust then you should also consider drawing down early. The protection provided by the Pension Protection Fund (PPC) is pretty good for defined benefit pensions and if you haven’t started to draw down on the pension yet you will have 90% of the protection covered (up to £38,500 – in 2018). The advantage of drawing it early is that as soon as you start taking a defined benefit pension it is 100% protected by the PPC. My scheme is funded by the government so personally this is not a risk.

Also you might consider that most people spend less the later into their retirement they go. Personally I’m ignoring this fact as I don’t want to have a plan that forces me to cut spend. If I have spare money I know plenty of worthy places that I can send it.

Another event that might warrant an early draw down is if the market suddenly crashed. By drawing the pension early you could reduce what you need to draw from your investments when they are low. Or if you still generating enough other income you could draw your pension and then invest when shares are devalued as well.

Why might you not want to draw your pension down early?

However, you do need to be very careful when making this decision as you can’t reverse it once you’ve made the choice. Without a doubt a huge benefit of defined benefit schemes is that once you start drawing it down it is 100% safe and will increase in line with inflation. This gives a massive peace of mind, even if all of your investments disappeared you know you’ll still be getting a steady income. For instance, if you were a couple and received a defined benefit pension of £5,000 a year and a full statutory pension this would provide £22,092 of income per year (using 17/18 pension). That really takes the pressure off of your investments funding your retirement income.

So you may decide to make a choice that doesn’t necessarily give you the best expected financial return, but gives you certainty. Certainty it’s a rare thing with investments and the peace of mind of a fixed income can allow you to relax and enjoy your retirement.

You may have such a good defined benefit pension you know that this will be enough to fully support you in retirement. If so a better idea for retiring early could well be to aim to build up savings to get you to your retirement age, and then live off of your guaranteed income.

Finally, if you a worried the stock market is about to crash you might want to carry on working a bit longer so you don’t risk drawing the pension and then seeing your early withdrawals diminish in value. This would otherwise drive a big hole in the whole benefit of drawing down the pensions earlier. Although we all know we shouldn’t try to time the market.

So how many years should a draw the pension early?

This one really is impossible to say, and will depend on your own circumstances. At the moment my personal model has my wife and I both drawing our defined pensions 5 years early. We could draw it down even earlier based on the numbers above, but not doing so still leaves us with a nice amount of guaranteed income every year. But who knows what might change by the time we come to that 5 year point?

Conclusion – should you draw your defined benefit pension early?

The answer to this question will come down to your risk appetite, and the terms of your pension. I’ve based the calculation in this article on the Nuvos pension used by the UK government. From a purely financial perspective you are likely to find that drawing your defined pension benefit down up to 7 years early will leave you no worse off than if you waited until your statutory retirement age. Indeed for many people this should give you a better return, particularly if you are able to achieve returns of 5% on average per year.

The main factor that you need to balance this against is the loss of a guaranteed income in your retirement. Many of us will find that the comfort of know a large proportion, or possible all, of our needs in retirement are 100% covered a very compelling reason not to draw down early.

A useful thing to take away from this article though is that you have flexibility on what you decide to. Until you’ve actually started to draw down your pension you can always decide to wait a bit longer until you are sure of decision or circumstances change.