You can do the best planning the world has ever seen. But if you then assume everything will carry on along as you predicted for ten plus years then you will be in for a surprise, and probably not a good one. The world around you will change. Your circumstances will change. Your desires will change. It’s therefore important that you keep on track of how you are progressing towards your target to retire early. I’ve created a net worth tracker that can help you, and best of all it is available free!

Why bother tracking

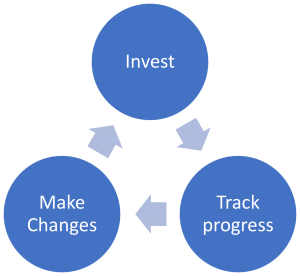

Here is my patented “why check on your retirements and not just let them fester™” infographic.

Deciding to start investing for an early retirement is not a one-off decision. Firstly, we start investing. Then we track our investments until retirement, and beyond. And then at certain points we will tweak our assumptions.

- Maybe we will try to save more?

- Or maybe we will change how much we want to have saved for retirement.

And this keeps on going around in perpetual motion. We keep on investing. We keep on tracking. And yes, we keep on adjusting (but not too much!).

What should I check?

You need to be able to check how your net worth is moving compared to your plans. Different people will include different things in their net worth. That is fine, I explain some of the options in the post “How to calculate total assets and net worth – what do you include?“.

What is most important is that whatever you are tracking will be the assets that are used to support you in your retirement. Also, that whatever metric and valuations you decide upon, you remain consistent over time.

How often should I check?

How often you decide to check your investments will somewhat come down to you as a person. Some people will love checking things every day. Whereas others would rather check in only once a year.

Checking every day is fine, as long as you don’t keep on making decisions based on it. A key part of long term investing is not continually moving investments around. You may find though that checking this regularly helps you invest some spare cash when the markets are low. But generally people trying to time the markets lose out..

If you are investing in Exchange Traded Funds then you can certainly check less often. These don’t need to be actively managed which is part of their appeal.

Personally, I check my net worth at least each month. I actually find it motivates me to see my savings hopefully growing. Also, it keeps me focused on the changes I need to make to close the gap.

How can I use the net worth tracker to help me?

You can use anything you like to track your investments. If pen and paper is your thing, then go for it!

Many people also use services such as Personal Capital or Mimt to help them track their net worth, as well as providing other services. Certainly, these providers can reduce the effort in tracking your investments, but it does involve sharing certain sensitive details with a third party.

If you are not comfortable in sharing these details then you are likely to find tracking your assets and debts will be easiest managed in Excel. This is where the personal finance statement template, aka the net worth tracker, that I have developed might help.

The net worth tracker is designed to allow you to keep a monthly check on your net worth. But more than that you can also set yourself some targets and see monthly how you are doing against them. And as an added bonus it includes a pretty dashboard for those of us that like those things! You can find out more at this page.

What if things are not going as well and I hoped, or need?

Things are worse

If you start to find that your financial investments are not performing as strongly as you hope, then you need to decide what action to take. The good news is that when keeping track of your position, you can make changes as soon as possible. The sooner you act, the bigger the impact.

It is important at the offset though to understand why your investments are not growing as fast as you need.

It may be that you are not able to save as much as you hoped. If so, then you will want to act.

- How can you earn more income?

- How can you reduce your spend?

This will be the trigger for you to re-focus your energy in make sure you are investing enough each month. Alternatively, it may simply be that you will not be able to retire as early as you hoped.

A massive part of being able to retire early is the impact of compound growth on your savings. And this why keeping on top of your finances will make it much more likely you will hit your target. You can make it easier to hit your plans by quickly taking action

- Let’s say you are slightly off target, but that by saving an extra £100 a month you will get back on track to retire in 10 years.

- If you only found out about this gap after five years (and assuming 4% annual growth), you would need to save an extra £222 per month for five years.

- The quicker you can act, the smaller any change you need to make will be.

It may be that your investments are not performing as well as you hoped. If you are still some time off your retirement and it is due to a general economic downturn then you will probably want to hold your nerve. You should always expect investments to have some periods of reduction. But the normal outcome is that over a 5-10 year period you will get the required growth.

However, if the general stock market is doing okay, but your selected investments are not generating the desired returns it will be important to see why.

You can’t afford to have underperforming investments over a ten-year period.

Perhaps the most important piece of advice is not to panic.

What if things are going better than I hoped, or need?

Mainly I would say, keep on saving hard! If you keep your foot on the throttle you will either be able to retire earlier, or with a bigger buffer.

Of course, you may decide to treat yourself early by drawing down on some of the funds. That’s fine.

At the end of the day money is there to help you enjoy your life.

A large part of early retirement is deciding to delay spending money now, to allow you to live the life you want later.

Although I would caution that you could find tomorrow your investments drop in value. Especially if your growth is due to a booming economy, there could be a bear market around the corner.

In other words, if you’re only doing better done to the current market circumstances, you’e better to just keep on carrying on as you are.

Worst case scenario =you end with more savings than you need.

What next?

With a fair wind, at the end of using the net worth tracker you will be well on progress…

You will be able to retire*!

…

* Unfortunately you will need to keep on tracking your investments after you retire. Unless you intend to take out an annuity *

…

* DON’T DO IT! Try out the free net worth tracker.