You can have free access to the Personal Finance Statement Template that will help you track what you are worth. It should be as simple and user friendly as possibly, whilst also providing a really useful dashboard

If you want you can simply use it to track each month, or whatever frequency you decide, how your net worth is growing. Hopefully.

If you are more adventurous you can put in a target retirement date and a target level of retirement funds. This is then more powerful as it will help you see how close you are each month to reaching your target! It will also tell you how much more you need to save.

I’d really appreciate feedback on how you find this tool. So if you like or dislike anything please contact me to let me know. Any feedback will help me develop this tool more for other people. In particular I’m interest in:

- What you can’t get to work/errors

- What you like or dislike about it

- Future improvements you can think of

The personal finance statement template is available to you free if you simply sign up for the weekly newsletter where you will also be kept you up to date on a weekly basis with the articles posted here.

Instructions for using the spreadsheet

Input your starting data

About you

About you

This section includes some key information about you and how much you are currently investing. You might well find once you’ve populated this sheet you don’t have to come back to it very often unless your circumstances change.

Country: Pick between the US and UK. At the moment this just changes the currency. Future updates will make this choice more useful.

Starting date to track: Put the first date that you want to start tracking your net worth/financial position from. You can back date this if already have historic data, or just pick a specific month.

Monthly retirement savings: Here insert how much money each month is being contributed to your liquid monthly savings. So anything you are adding to cash, investments, and retirement funds. You should include any amounts that your employer also adds here.

Monthly illiquid asset growth: In here add any growth in your net assets that you expect on top of the ‘monthly retirement savings’ above. For me the only item here is a reduction to my mortgage each month.

Inflation for illiquid assets: You can decide to have you illiquid assets growing each month by inflation, or not. Personally I would recommend picking not here. Otherwise your need to keep on re-valuing the illiquid assets every month, or you will start to slip behind a growing target.

About your targets

This section includes information about your retirement plans.

Retirement date: Simply type in the date you want to retire or achieve financial independence. This is key as it will impact the growth targets you have, and also the graphs in the dashboard.

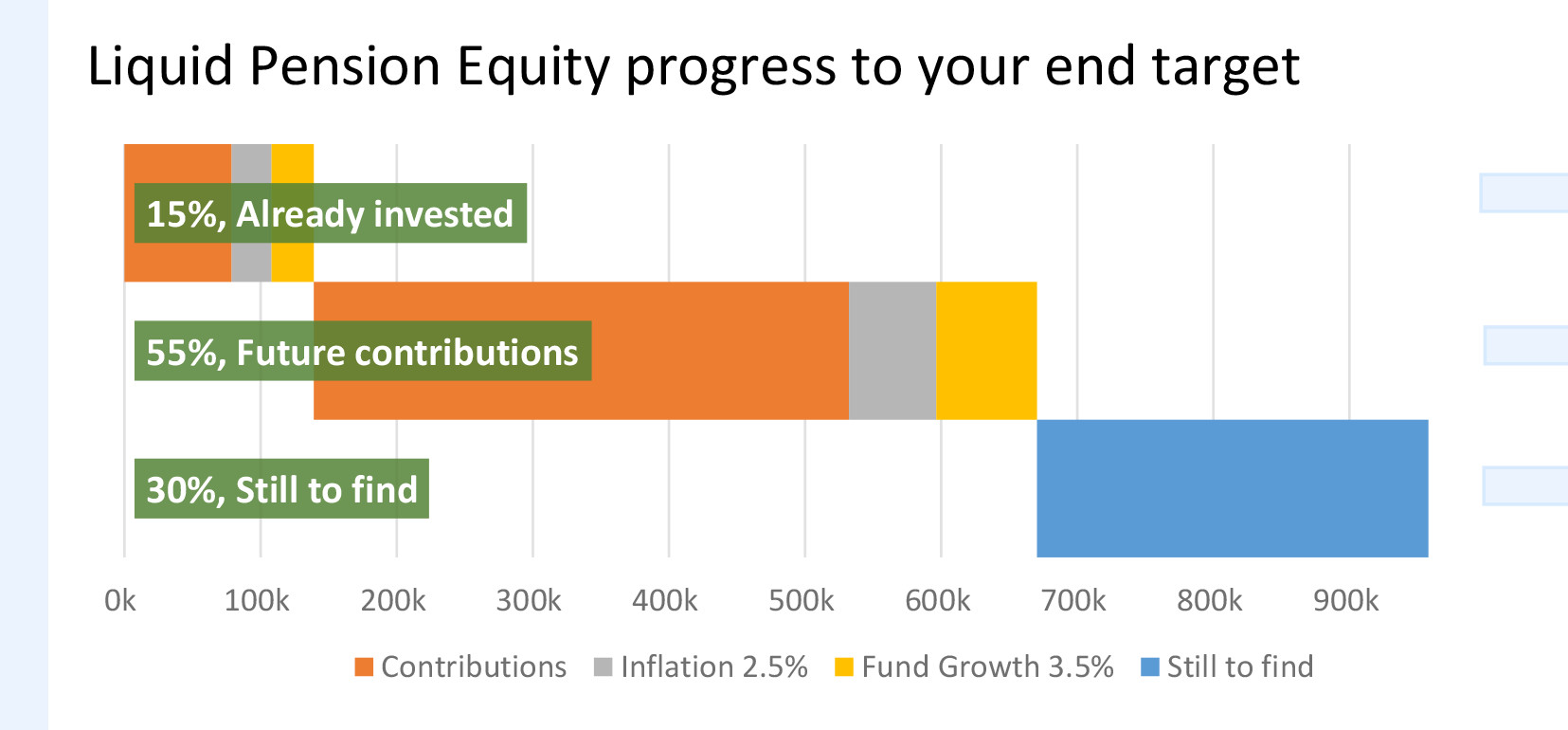

Liquid retirement equity: Put here your target amount of liquid retirement, in todays values, at your date of retirement. This number links in with the number you put in ‘Monthly retirement savings’, as these amounts will be how how reach your target

Net worth equity: Put here what you want your total net worth to be once you reach retirement age.

Real value date: This allows you to change the date that the future inflation is started from. If you leave it blank then it starts from the first date you start tracking. If you insert a new date then it will start working out future inflation from that date. This can be useful if you have say 2 years worth of data on your net worth. By putting todays date it will mean the targets you put in the two cells above can still be in todays value, rather then 2 years ago.

About the world

Inflation: Just put what you expect inflation to be (or leave at the 2.5% rate)

Investment growth rate: Put here the growth you expect from your investments excluding inflation.

Gross compound growth: This is an automatic calculation based on the two cells above.

Average fees to deduct: Put here the amount of average fees you expect to save on your investments.

Real term growth per year after fees: This is another automation calculation that shows the real net growth you will gain each year after fees.

Input your monthly data

This tab is the bread and butter of the worksheet. Here every month you can type in the value of the assets and debts you have. You might not bother to work out all of them each month. I have some tiny retirement funds that it’s really not worth my time seeing if they have increased or decreased by £10. But you should make sure you update the the larger numbers that will really impact your net worth.

You will notice a + icon above the total of each section. If you click this you can add in an extra column in that section. This will help you keep logical groups of items.

Here is a brief rundown of the sections. The first 3 are of particular importance as together they make up your ‘Liquid retirement equity’. This is basically the investments you are growing that you can live off in your retirement.

- Liquid investments. Here you can capture your stocks and shares, bonds, and other such investments.

- Cash. I think this is self explanatory!

- Contribution retirement funds. Any retirement funds that you (and hopefully who you work for) invested that do not have a guaranteed return. These are defined contribution pension schemes.

All the rest of the items then are added to the ‘Liquid retirement equity’ to give you your net worth.

- Defined Retirement Funds. Rarer now, these are These are defined benefit pension schemes. Here you will have a guaranteed income per year on retirement. You should put the value of the fund here, not the

- Property. Input here any property you have. I would suggest inputting at the market value and include any mortgages in the debt section.

- Other assets. You can add anything else here of value that you own. Cars, property, collections’ etc.

- Secured debts. In this section include any debts that are secured against an asset you own. Mortgages are the most common items for most people here.

- Unsecured debts. Any other debts such as unsecured loans, credit cards, and that $100 you own to uncle.

Use the dashboard!

This tab is the fun part of the worksheet! For the most part all you have to do her is gaze in wonder and awe at how well you are doing. Or possibly shed a small tear if the stock market has taken a dive 🙁

The only things you can change here are the display of the graphs on the middle. The light yellow squares indicate what you can adjust:

- You can change the timescale to either ‘current’ or ‘long term’. ‘Current’ will show your progress from month one to today. It will default to 12 months minimum for aesthetic reasons. Long term will show you everything from your first month to your target date of retirement.

- You can change the minimum and maximum of the vertical axis. NB for any changes to take effect you need to click on the cog wheel.

Don’t forget, all you need to do to get free access to this resource is to sign up to the weekly newsletter. Once you sign up you will be given details on how to access this and all of the other free resources at 5 steps to an early retirement.

Disclaimer

Any information provided is not personal advice. You are responsible for your investment decisions and all tools provided are for illustrative purposes only. If you’re not sure whether an investment is right for you, contact a financial adviser. All investments can fall as well as rise in value, so you could get back less than you put in. Please remember, past performance is not a guide to future returns and that income is variable, not guaranteed.